The 5 Biggest Threats To FMCG Companies

Most FMCG has been pretty much insulated from the challenge of disruptive new business models by having brands with strong equities, good relationships with retailers, and prohibitively expensive manufacturing set-ups. However, it is not going to stay this way.

There are 5 trends that together are starting to create a very explosive environment. And if you want further evidence that it is going to happen – take a look at the P&G Gillette example at the end of this article.

The 5 Trends

1.  Lower Cost Of Entry

The historic high cost of entry into a category or marketplace is falling due to;

- The ease with which you can source globally, from a plethora of private label suppliers and undercut established players;

- Being able to cut out retailers with a direct-to-consumer web-shop;

- The ability to create a brand and build it from nothing on YouTube and via bloggers etc.

Jan Marini’s Age Intervention Eyelash Conditioner was the first of its kind when it launched in 2005. For those amongst you who are yet to purchase an eyelash conditioner….it helps your eyelashes to grow fuller and longer. Marini’s still commands a price premium, retailing at around £60. However, it you were to enter ‘eyelash conditioner‘ into Amazon there are at least 50 competitive products from pretty much unknown brands, ranging in price from £5 to £35. And you can buy some of the more affordable ones in the supermarket. This is a good example of the speed with which an innovation can now be followed and substantially undercut.

As prevention is better than cure, here are our top tips if you find yourself in a similar position to Marini.

2.  Internet Integration

Not only is internet penetration still increasing, there is an increasing willingness and comfortableness to purchase goods online for home delivery.

A survey for The Grocer in the UK by Harris Interactive suggested that about 35% of UK consumers were willing to purchase food, drink and household items direct from the manufacturer.

Nielsen sum it up beautifully with “The milkman is back, but this time he’s gone digitalâ€

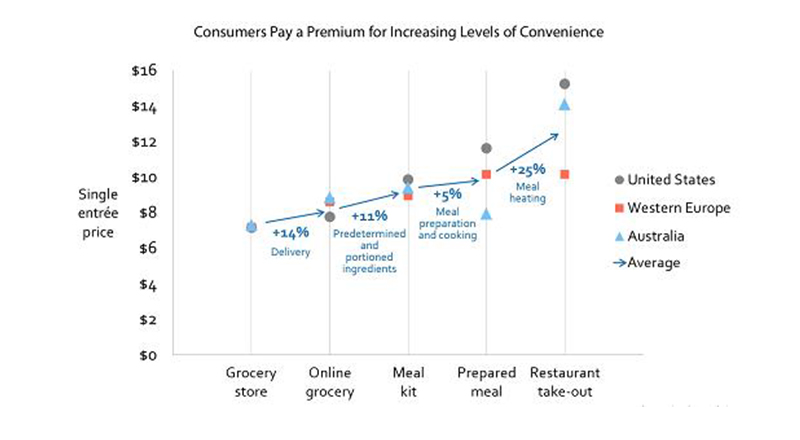

3.  Availability Over Desirability

There seems to be no end to people’s need for ever more convenience. And time is becoming the most precious of commodities. ‘Just in time living’ is here to stay.

Brands that were once driven by being the most enticing are quickly realising that desirability is being topped by being the most easily available.

Source: Lux Research

Brands like Blue Apron and UberEATS are capitalising on the premium that consumers are willing to pay for convenience and availability.

4.  The Last Mile

The last mile from a good’s end destination has historically been cost prohibitive to many direct-to-consumer business models. But with the introduction of autonomous ground vehicles (Ford announced it is aiming to have a “fully autonomous vehicle†on the market in 2021) and delivery drones on the horizon, the playground is going to change substantially.

Zipline, a Silicon Valley robotics company, in partnership with the Rwandan government, use drones to deliver life-saving parcels of blood and vaccines to remote areas of the country. The drones have cut delivery times from 4 hours to an average of 30 minutes.

5.  3D Printing

We wrote an article 2 years ago about 3D printing being the future. It is now predicted to truly gain in-home traction in around 2-3 years’ time. This is the game changer to end all game changers! New challengers will be able to shortcut the whole value chain completely – no more transport costs, or cost of goods versus retail price equations etc.

Still think we are being over dramatic? …too futuristic? Take a look at this real-life case study then see if you still don’t think that trouble is coming…

The Gillette Case Study

Source: Gillette

Gillette’s owner is Proctor & Gamble, one of the biggest FMCG companies there is. And a company with a very solid record of innovation, albeit in product development (ingredients, fragrances, pack structure etc.) rather than business models.

In 2010 Gillette owned 70% of the US razor market. That share has dropped to 56% in 2016 (Euromonitor). The cause? Two start-ups with different business models…

Dollar Shave Club

Source: Dollar Shave Club

Started by two entrepreneurs in 2012 with no retailer relationships, no established brand and no manufacturing capability. It offers a cheap online subscription for blades and razors delivered to your door, on a monthly basis. The brand was built on YouTube with a video (that went viral) and cost $4,500 to produce. And the blades and razors are sourced from South East Asia.

Within 36 months the Dollar Shave Club captured 6% share of the US market. By the end of 2016 this had grown to 16% share (by volume) via 3.2 million members, generating $200 million in revenue. Along the way it was brought by Unilever (P&G’s arch rival) for $1 billion. Until this point Unilever did not operate in the razors and blades category!

Harry’s

Source: Harry’s

Again, launched by two entrepreneurs in 2013, Harry’s is another online razor and blades subscription model that is a direct-to-consumer business model. But, the consumer proposition is different… German engineering with a whiff of vintage. The pricing is also at a premium to Dollar Shave Club but well under Gillette’s retail price. And they brought a German manufacturing plant for $100 million before their first birthday!

It is now the third largest brand in the US and commands 25% on the online market compared to Gillette’s e-commerce share of 21%.

Others

Hot on the heels of Dollar Shave Club and Harry’s is crowd-funded, UK brand Cornerstone who offer German engineering and skincare products suitable for sensitive skin for their subscription members.

So, if it can happen to P&G….

And if you still need convincing, check out 6 Examples Of Innovative FMCG Business Models.

What are the potential threats to your brand? I’d love to hear from you and work out a solution.Â

Wait! Before you go…

Choose how you want the latest innovation content delivered to you:

- Daily — RSS Feed — Email — Twitter — Facebook — Linkedin Today

- Weekly — Email Newsletter — Free Magazine — Linkedin Group

Shelly Greenway is a front-end innovation strategist and partner at The Strategy Distillery – a brand innovation consultancy that specialises in opportunity hunting and proposition development. Their success rates are driven by their proprietary consumer co-creation IP. Follow @ChiefDistiller

Shelly Greenway is a front-end innovation strategist and partner at The Strategy Distillery – a brand innovation consultancy that specialises in opportunity hunting and proposition development. Their success rates are driven by their proprietary consumer co-creation IP. Follow @ChiefDistiller

NEVER MISS ANOTHER NEWSLETTER!

LATEST BLOGS

How Brexit Has Affected UK E-commerce Businesses

Photo by Zyro on Unsplash The popularity of online shopping was already growing at an impressive rate – and…

Read MoreOvercoming range anxiety: three tips for EV owners

Photo by Jenny Ueberberg on Unsplash In the last few years, electric vehicles (EVs) have become more and more…

Read More