Mainstream Payment Systems Adopt Cryptocurrencies: Will We See a New Retail Economy?

For over a decade, Bitcoin has been seen as a nuisance at best and a hindrance at worst. Financial incumbents, including national banks, investment funds, and industry experts, have never considered cryptocurrency a viable replacement for fiat money. However, as more people are looking for ways to buy Bitcoin, pay the bills in cryptocurrency, or perform international transactions, the attitude towards Bitcoin has finally started to shift. Even the largest global payment processing systems are taking steps towards cryptocurrency adoption.Â

Is it a sign of an emerging crypto retail economy? Let’s dive into the details to understand how likely that is.

Mastercard Is Open for Cryptocurrency Partnerships

As one of the biggest players in the payment processing market, Mastercard cannot afford to ignore the fact that up to 20% of the population in certain countries holds cryptocurrency. Considering the increasing demand for safe and fast ways to deal with tokens, the company expanded its Accelerate program. It enables FinTech startups and cryptocurrency companies to get access to Mastercard’s technology and expertise while providing their customers with a secure way to deal with crypto and fiat currencies.Â

For now, Wirex is the best example of Mastercard’s efforts. The company, founded in 2016 and previously known as E-Coin, gained principal membership that allows it to issue payment cards directly to its customers. As a result, over 100,000 users got access to the ‘two-way cards’ that can process both crypto and fiat currencies.Â

Wirex is likely to be the first of the many cryptocurrency startups to make the most of Mastercard’s Accelerate program. Considering the streamlined approval process, many budding FinTech companies can take part and enjoy the benefits. Still, they’ll have to prove the security of their operation and the compliance with local regulations preventing money laundering.Â

Visa Advances Digital Currency Approach

Visa isn’t one to fall behind and is also taking steps to solidify its presence in the cryptocurrency market. For one, the company filed a patent for digital fiat currency in late 2019. The patent describes a system that can, in theory, replace cash. The digital currency can be issued by a national bank and take over cash without undue friction. But the patent isn’t likely to be narrow enough to be enforceable; moreover, it might not even result in a new product or feature. After all, Visa files dozens of patent applications every year. It might just be an attempt by the company to protect the current ecosystem.

At the same time, Visa has been actively working with the most stable cryptocurrency platforms, such as Fold and Coinbase. Over two dozen crypto wallets are already connected to Visa services, providing users with an easy way to exchange their tokens for fiat currency. Similar to Accelerate, FastTrack program by Visa helps FinTech startups connect their offers to the existing card infrastructure, thus adding reliable functionality and security.

Visa’s expenses also shed light on the company’s interest in digital currencies. In 2019, the payment system invested in Anchorage, a company working on the digital currency security infrastructure. The R&D team is also working on digital currency innovations, including offline transactions and improved scalability, which currently limit the adoption of Bitcoin and altcoins in the global economy.

PayPal Is Rumored to Adopt Crypto Payments

While Visa and Mastercard are already well on their way to cryptocurrency adoption, PayPal has fallen behind. The company has been extremely careful in its steps towards Bitcoin ever since the first attempts in 2013. PayPal was even one of the Libra Association founders working on Libra stablecoin. However, the company had to back out to prevent regulatory pushback. Despite regular comments by PayPal’s management about the inevitability of cryptocurrency integration into the feature set, there is no official information on when it may occur if at all.

The rumors of the direct crypto-asset sales to be integrated into PayPal and Venmo appeared in June 2020, but the company refused to comment. In the meantime, the company published job openings for a cryptocurrency engineer and Bitcoin research engineer, which may prove PayPal’s plans for digital currency integration.

The shift towards the crypto market might be in PayPal’s future, considering the number of token users that now exceeds 50 million. While PayPal’s user base is considerably larger (over 300 million globally), the company could still gain new clients and bridge the gap between crypto and fiat currencies for millions of users. Besides, digital asset operations could help PayPal take on digital wallet apps that are slowly taking over the FinTech market and luring customers away with the promise of safer, faster, and cheaper transactions.

PayPal is known to follow customer demand, and crypto users have long been waiting for PayPal’s crypto integration. Some wallet apps and exchange platforms do offer direct withdrawal and deposit options, but those are few and far between. If PayPal becomes more cooperative, it can become an invaluable onboarding resource for the crypto market. As a result, we’ll see an increase in Bitcoin owners, as well as the number of merchants willing to accept digital tokens along with fiat currencies.

With Mastercard and Visa offering more cryptocurrency support options, PayPal is likely to follow in their footsteps in the coming months or years. However, even with the support of three international financial giants, the crypto market is far from becoming mainstream. Regulatory obstacles are among the critical adoption barriers. National legislation-makers and international regulators are still working out ways to make digital currencies safe for all stakeholders, from banks to merchants to end-users. While customers enjoy the untraceability of cryptocurrencies, some countries are banning them for the same reason. Unregulated, decentralized tokens are unlikely to form a new retail economy, so we’ll have to wait until the crypto market is made secure before it can replace the current system.Â

NEVER MISS ANOTHER NEWSLETTER!

LATEST BLOGS

iPhone Followup – Innovation in a Box

My initial iPhone article highlighted why the iPhone will not be a success in its first incarnation. Make no mistake though, the introduction of the iPhone will revolutionize the mobile telephony market. Let’s answer some of the criticisms of the most innovative mobile handset in the history of mobile telephony:

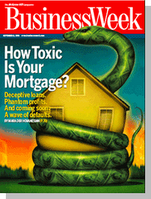

Read MoreThe Growing Housing Divide

I was speaking with a friend of mine recently and he brought up an interesting point. He asserted that there was a widening gap in home prices between where people want to live and where people have to live. How else can you explain the housing price fall in most of the country while places like Seattle continue to have rising prices?

Read More