The Need for True Financial Innovation

Facilitating Mobility for People in Banking – a Paradigm Shift

Facilitating Mobility for People in Banking – a Paradigm Shift

While mobile solutions companies continue to drive product development and their point solutions under the banner of technological innovation the more they miss the plot. So much focus and effort seems to be invested in taking an existing product and merely re-platform it to be functionally available through a mobile platform, while little effort is being invested to fully understand the mobile user and their mobile social and business behaviors and facilitating these through mobile applications.

By way of example and generally speaking, banks invest a lot of money is developing mobile banking applications then patting themselves on the back for being so innovative. All they have done is give the customer the ability to do what they have always done, but in a remote fashion. This is not innovation. They have not provided any new service or product that the customer could not already have obtained via their fixed PC or mobile laptop using a wireless modem. As far as I am concerned that’s business as usual, just more convenient.

With the convenience of mobility comes the ability to be really innovative, to break down the barriers of traditional brick and mortar type banking that goes under the guise of “mobile banking†and create brand new models for managing money, where mobile money and mobile banking converge and are mapped synergistically to a customer’s mobile behaviors in terms of business, trade and social interaction.

Mobility in banking has opened up avenues for banks to secure business from the traditionally un-banked. They have all gone off merrily providing their existing services on a mobile platform. But guess what? They still charge an arm and a leg for transaction fees thereby cutting off the very people they are trying to attract. No cognizance has been taken of the potential customers behaviors mentioned above and how they view the bank from a cultural perspective and what this sector of the market is really looking for from a mobility perspective.

Once banks are willing to accept a paradigm shift away from an old school pure revenue driven business model to one that also considers and embraces social and cultural behavior and provides customers with real value in terms of cost saving and in a manner that suites them, then we will have seen real innovation in the mobility space for banking.

Don’t miss an article (3,000+) – Subscribe to our RSS feed and join our Innovation Excellence group!

Colin Crabtree been in the IT business in varying roles over the last 30 odd years ranging from “techie” to board of directors and am a passionate innovation evangelist at heart. I have in my years gathered a broad spectrum of experience in many aspect of business from innovative (and failed start-ups) to corporate giants. I write articles on creativity and innovation and love engaging in debate on the subjects.

Colin Crabtree been in the IT business in varying roles over the last 30 odd years ranging from “techie” to board of directors and am a passionate innovation evangelist at heart. I have in my years gathered a broad spectrum of experience in many aspect of business from innovative (and failed start-ups) to corporate giants. I write articles on creativity and innovation and love engaging in debate on the subjects.

NEVER MISS ANOTHER NEWSLETTER!

LATEST BLOGS

A Strategic Position – Wal-mart and Banking

There was another article in the Seattle Times today about retailers and their desire to move into banking. The article…

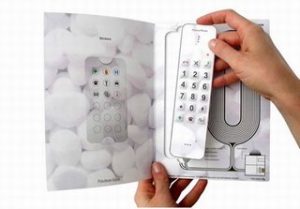

Read MoreIs the Post-a-Phone an Innovation?

I came across an article on Engadget about a phone that is so flat you could mail it. Sure it…

Read More